Welcome to Global Business Loans

Funding to fuel and upgrade the scale of your business

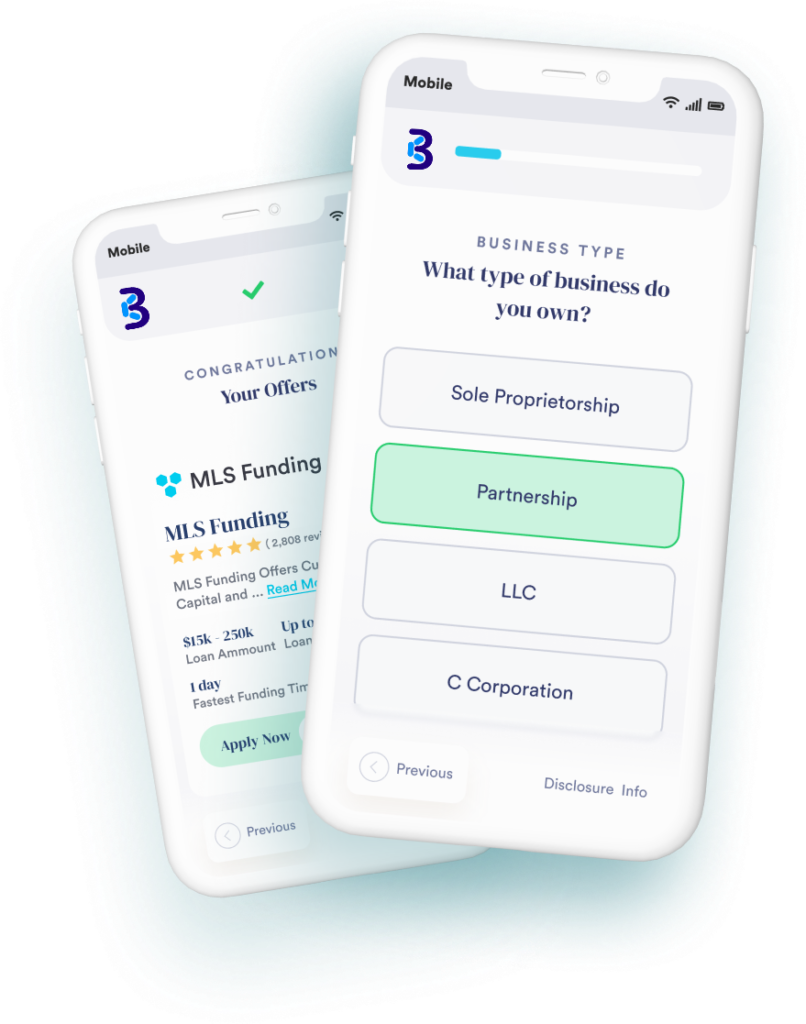

Compare multiple loan options at once and choose the best that fit for needs with confidence

HOW IT WORKS

The Process

Answer some basic questions in less than 3 minutes with no impact to your credit score and compare multiple offers. YOU are in the driver’s seat!

SMALL BUSINESS ENTHUSIAST

What We Do

Using proprietary technology, we quickly review your business information and match you with the right lending partners. We are connected to a vast network of lending professionals we handpicked to help fund your capital needs. With loan standards frequently changing, we stay on top of it all for you to deliver the right lenders at the right time.

Short Term Loan

Short Term Loan

A loan that is set to be paid back in a short period of time—typically within a year or two, sometimes longer. Most common uses include working capital, inventory or equipment purchases, and marketing. Short term loans also typically allow for quicker and easier access to funds with more flexible underwriting standards.

![]() Line of Credit

Line of Credit

A revolving loan that provides a fixed amount of capital and that can be accessed when needed. Unlike a traditional term loan, all or part of a line of credit can be accessed on demand up to a fixed limit. The customer pays interest only on the outstanding principal amount in use.

Long Term Loan

Long Term Loan

A long-term loan is smart to consider when making a large investment or looking to expand, typically 5 to 10-year terms with potential up to 20+. These loans can have a fixed or floating interest rate. Longer term loans may also require collateral, such as real estate to be pledged when securing the loan.

![]() Merchant Cash Advance

Merchant Cash Advance

While not technically a loan, a cash advance typically does not require a true Personal Guarantee so may be riskier for the lender. Cash advances generally do not have a set term, payment schedule, or stated interest rate like a traditional loan. Instead, cash advances typically have a total payback and purchase a fixed percentage of the customer’s future cash receivables.

Frequently Asked Questions

Can I get a business loan after bankruptcy?

A bankruptcy in your past doesn’t necessarily preclude you from getting a small business loan, but it might make it more challenging. While not all lenders have the same requirements after bankruptcy, it’s unlikely a customer would qualify within the first year. Many lenders will require at least one year of improving credit history following the disposition of a bankruptcy.

How long will it take to receive my funds?

Timing for receiving approved funding depends on many factors. Each lending partner has its own approval process and can result in differing funding timelines. The typical time to fund can be anywhere from 24 hours to 1 week.

What is a line of credit?

A line of credit is a revolving form of credit that provides a predetermined capital limit and can be accessed as needed. Unlike a traditional term loan, all or part of the line can be accessed at any time up to the predetermined limit. Interest is only paid upon the amount actually used.

What is collateral?

Collateral is any asset or assets, which can be offered by a customer to secure a loan. Should a customer default, the lender can take possession of the asset, or assets, to satisfy the loan.

4.8/5

1860 Reviews

4.6/5

1630 Reviews

4.7/5

2100 Reviews

Get One Step To Your Loan

To evaluate your particular situation you can quickly make an appointment with us by clicking on the button below