Best Invoice Factoring Companies

Best Invoice Factoring Companies

Invoice factoring, or financing that allows you to get cash advances against unpaid invoices for your business, can be a good option for businesses that need an infusion of capital to cover a change in overhead or to help them scale. It’s a handy option for some businesses, as invoice factoring with no credit check is more common than with more traditional loans. With that comes invoice factoring interest rates, which tend to be higher than traditional loans. A business should carefully weigh its invoice factoring and other lending options, comparing invoice factoring companies’ terms and fees to determine what is right for them.

The Best Invoice Factoring Companies

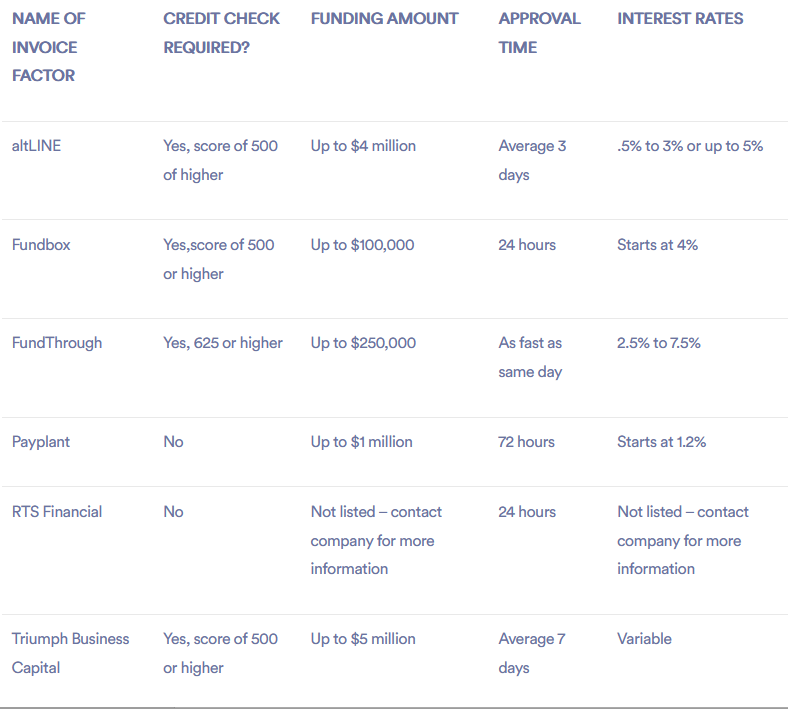

There are many different invoice factoring companies you can consider for your financing needs. They vary based on rate structure, fees, repayment terms, funding amounts, approval and turnaround funding times, and more.

Invoice factoring rates will depend on the terms of the company, the credit history of your customers and sometimes you and your business, the volume and balance total of the invoices, and the repayment terms. Invoice factoring financing is a good option if you do not qualify for more traditional loans, if you have a one-time or irregular need for cash and have healthy accounts receivable, or if your customers tend to be slow to pay invoices. You need upfront capital to cover overhead or recurring expenses.

Here are some of the best invoice factoring business cash advance companies:

Different invoice factoring companies offer different terms that may be more or less attractive to you based on your business needs. For example, you might focus more on an invoice factoring company with faster approval and cash advance turnaround times. Or you may be keen on identifying potential companies that do not run credit checks or have minimum credit score requirements to qualify. Tools like Globalbizloans.com make it easy to compare invoice factoring companies and other lending options to select the right financing for you and your business

Most Popular Guides

Online Financing with

No Credit Check

Invoice financing, or capital paid against a business’s unpaid invoices, can be a helpful option …